Commercial ‘Cloud’ Dwarfed by ‘Perpetual’ Software Licence Spend

Prologue

Around about the time that Adobe moved its software products ‘lock, stock and barrel’ over to a subscription based licensing program, we were being bombarded with hyped up ‘Cloud’ stories that proclaimed “Armageddon” for ‘Perpetual / on-Premises’ (we’ll refer to ‘Perpetual / on-Premises’ as ‘non-Cloud’) software markets by the year 2015 / 2016.

However, if you work within the software industry, whether that be in the ‘Cloud’ or ‘non-Cloud’ markets, you may have a different viewpoint to the generic statements being touted around by

‘Cloud’ advocates. Debates often ensue over the subject of the ‘Cloud’ and its rate of adoption, which invariably ends in a stalemate as neither side is normally armed with hard facts and figures to back up their argumentations. We are admittedly only very tiny tadpoles circling around a gigantic IT ocean and our individual experiences carry insufficient weight for either side to concede.

Well, 2015 is now upon us; the ‘Cloud’ has not taken over the universe and there are now some historical hard facts to throw into the ring and add weight to this debate. This report contains financial statistics, taken from the top 3 software vendor’s annual financial reports, which paint a rather interesting and possibly to some, a surprising picture of the current size of the commercial ‘Cloud’ and ‘non-Cloud’ software licence markets. This report does not refer to the consumer markets.

Summary Revenue Breakdown

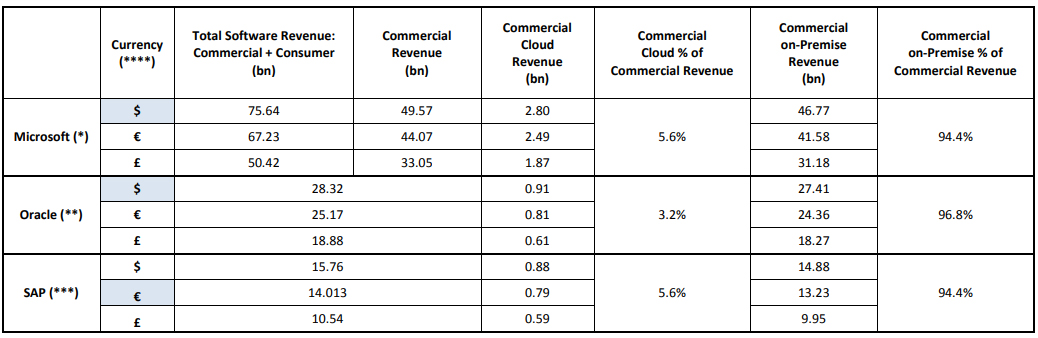

The following summarises the key ‘Cloud’ / ‘non-Cloud’ points taken from the top 3 software vendor’s annual reports, although due to the relative size and availability of relevant financial data,

the statistics do lean towards that of Microsoft’s data. Note that the next section in this report elaborates on the statistics summarised below to provide a more detailed breakdown.

- Between the top 3 software vendors, commercial ‘Cloud’ software sales account for between 3.2% to 5.6% of the total commercial software spend (2014);

- Microsoft’s annual commercial ‘Cloud’ software revenue grew by 115% to hit a total of $2.8bn for the financial year ending in 2014, which equated to 5.6% of a total of $49.57bn spent by businesses on Microsoft software licensing during 2013-2014;

- Revenue for Microsoft’s commercial ‘Cloud’ software has increased by an average of $0.93bn annually over the past 3 years (2012-2014) to reach its current $2.8bn level, although Microsoft does claim that its commercial ‘Cloud’ software revenue has hit a ‘run rate’ of $4.4bn;

- In 2014, Microsoft’s commercial ‘non-Cloud’ software spend increased by $2.34bn on the previous year, contributing a total of $46.77bn revenue. Microsoft’s commercial ‘Cloud’ software revenue increased by $1.5bn over the same period, contributing a total of $2.8bn revenue;

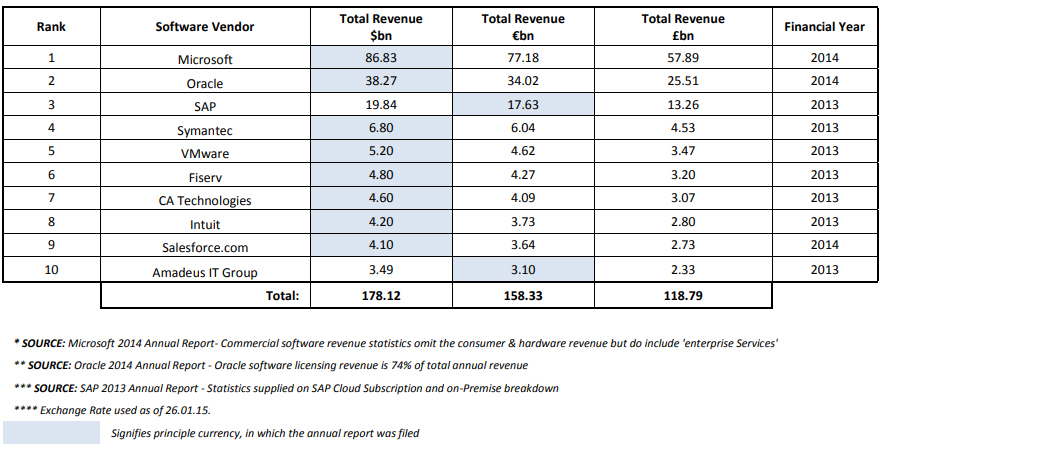

- Microsoft’s total annual revenue (comprising of consumer and commercial software, hardware and services) increased by a total of $8.98bn to hit $86.83bn for the financial year ending in 2014;

- The top 3 software vendors (Microsoft, Oracle, SAP) account for over 81% of the total revenue of the world’s ‘Top 10’, whilst Microsoft (on its own) accounts for 49%.

Detailed Revenue Breakdown

The following elaborates on some of the data summarised in the previous section:

Top 3 Software Vendors: Commercial ‘Cloud’ & ‘on-Premise’ Revenue Breakdown:

Top 10 Software Vendors: Total Revenue Breakdown (last financial year)

Closing Thoughts

- It is fair to say that the top 3 software vendors act as a benchmark for the software industry;

- With regards to Microsoft, commercial ‘non-Cloud’ software licensing revenue is increasing at a slower annual % rate; however it is growing at a higher value every year compared to commercial ‘Cloud’ software;

- The statistics indicate that the commercial ‘Cloud’ adopters may not have, to date, come from ‘non-Cloud’ software business users. It is more likely that the majority of the ‘Cloud’ revenue has come from businesses whom were using other Subscription or Open Source products;

- The growth of the commercial ‘Cloud’ over the last 3-4 years is very impressive to a tadpole like me but surprisingly, it still falls far short of the figures and generic statements touted around by some quite prestigious ‘Cloud’ Gurus and Research Analysts. Surely the question now is whether the growth of the ‘Cloud’, in terms of value (not % rate), will ever meet up to its hype. Has it been over-hyped? There is no doubt that commercial ‘Cloud’ will eventually start to build on its market share of the software industry but given the underlying facts, I would have to question the logic of anyone who still maintains that the majority of the software industry will be, in the near future, predominantly in the ‘Cloud’.

There is no ‘one-size-fits-all’ solution in the world of software.

For any enquiries about Microsoft software licences, simply complete the Contact Form. A member of our team will respond to your enquiry within 24 hours.